About

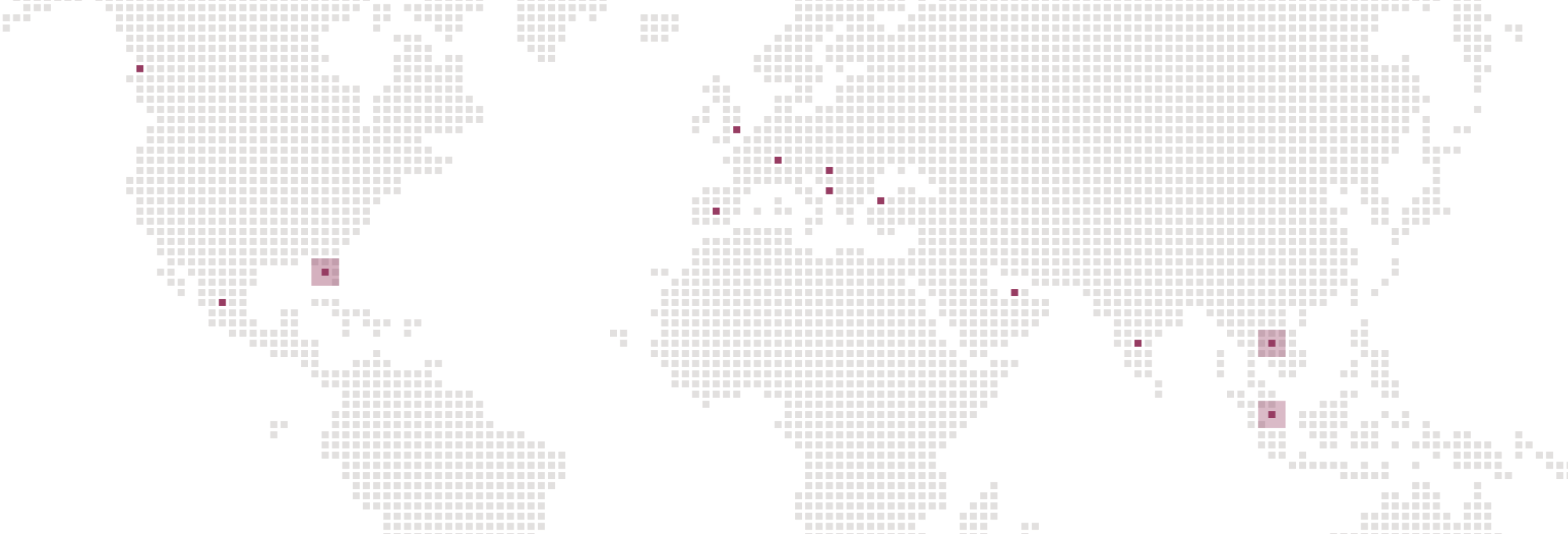

With seven physical offices and research & development centers and over 250 team members around the world, it is a global corporation able to take on any digital banking challenge.

Together with its clients, Mbanq defines how consumers engage with digital finance.

Corporate Vision

At Mbanq we befriend our clients, and bring them continuous expansion and innovation on a global scale.

Mission

Mbanq brings the next generation of financial services to an interconnected world through world-leading digital banking technology.

Mbanq maintains a strong global perspective while focusing on the United States and actively participating in South America, Europe, and Asia. With a strategic approach, Mbanq caters to the specific needs of financial institutions in these regions.

By combining global expertise with local market insights, Mbanq ensures that its solutions effectively address unique challenges and regulatory landscapes. This empowers financial institutions worldwide to embrace digital innovation, remain competitive, and thrive in an increasingly digital world.

Through its strong presence and active involvement across the United States, South America, Europe, and Asia, Mbanq continues to drive global transformation in the financial technology industry, enabling institutions to navigate the digital landscape worldwide.

Mbanq Head Office:

4850 Tamiami Trail N Suite 301 Naples, FL 34103

Phone: +1 (888) 999-5467

Email: hello@mbanq.com

FNLK Development Private Limited

Vasant Business Centre, No.15, second floor, Queens road, Vasanth Nagar, Bengaluru-560052

India

Mbanq Limited UK

Regus, Vision Park, Chivers Way,

Histon, Cambridge CB24 9AD

United Kingdom

HISTORY

Launched in 2016, Mbanq quickly established itself as a leading provider of banking technology.

An outlier in the FinTech industry, the quality of its technology and services-driven business model enabled Mbanq to reach profitability a mere three years after launch.

Headquartered in the USA, with technology, business development, regulatory and compliance and services support teams across Europe, the Middle East and Asia, Mbanq has expanded its client portfolio to become one of the fastest growing and most successful FinTechs in the world.

Today, Mbanq operates millions of accounts on behalf of its client platforms and continues to drive industry-leading BaaS innovation.

2016

Founded and incorporated in the USA

Acquires banking core provider (established in 2002)

Acquires European development team

2017

Expands US regulatory and compliance teams and services

New office in Singapore

Sales and delivery pipeline

Banking license sponsor relationships established

2018-2019

Acquires Agility Four to service Credit Unions

Reaches profitability

Launches Mbanq Labs accelerator program for startups

Further technology upgrades

Services portfolio strategy

2020

Core technology platform Mbanq Sky

Enhanced Banking-as-a-Service (BaaS) platform

Expands compliance teams

- Compliance- as-a-Service

- Regulatory- as-a-Service

- Dispute Resolutions-as-a-Service

2021

Mbanq CUSO

First in world Credit Union-as-a-Service (CUaaS)

Partners with Temenos to enhance technology and services

Partners with Galileo to enhance card issuing

2022

India technology development team and office in Bangalore

Lending-as-a-Service

Fourth accelerator cohort graduates from Mbanq Labs

US and worldwide banking technology patents granted

2023

Millions of accounts across client platforms

Embedded Banking for industries and brands

Expanded as-a-service portfolio

2024

High profile brand launch

Expansion to Latin America, following success in USA and the Caribbean

Rollout of new functionalities

Today, Mbanq is more than a successful FinTech company – it’s a ‘market maker.’ By foreseeing the future of banking, driving innovation, and leveraging industry wisdom, Mbanq has paved the path for BaaS, changing the face of the banking industry and empowering countless businesses along the way

LEADERSHIP & FOUNDERS

Vlad Lounegov

CEO (Seattle, USA)

Previously:

Co-founded PwC FinTech Practice

20+ years Big Four banking and FinTech consulting (KPMG, EY, PwC)

Lars Rottweiler

CTO (Zurich, Switzerland // Dubai, UAE)

Managing Director, Deutsche Bank

25+ years top-flight banking and consulting roles

(Deutsche Bank, PwC, Accenture, Infosys)