About

Mbanq fully empowers any bank or company to launch and operate modern digital finance anywhere and at any scale, effortlessly, quickly and resource-efficiently.

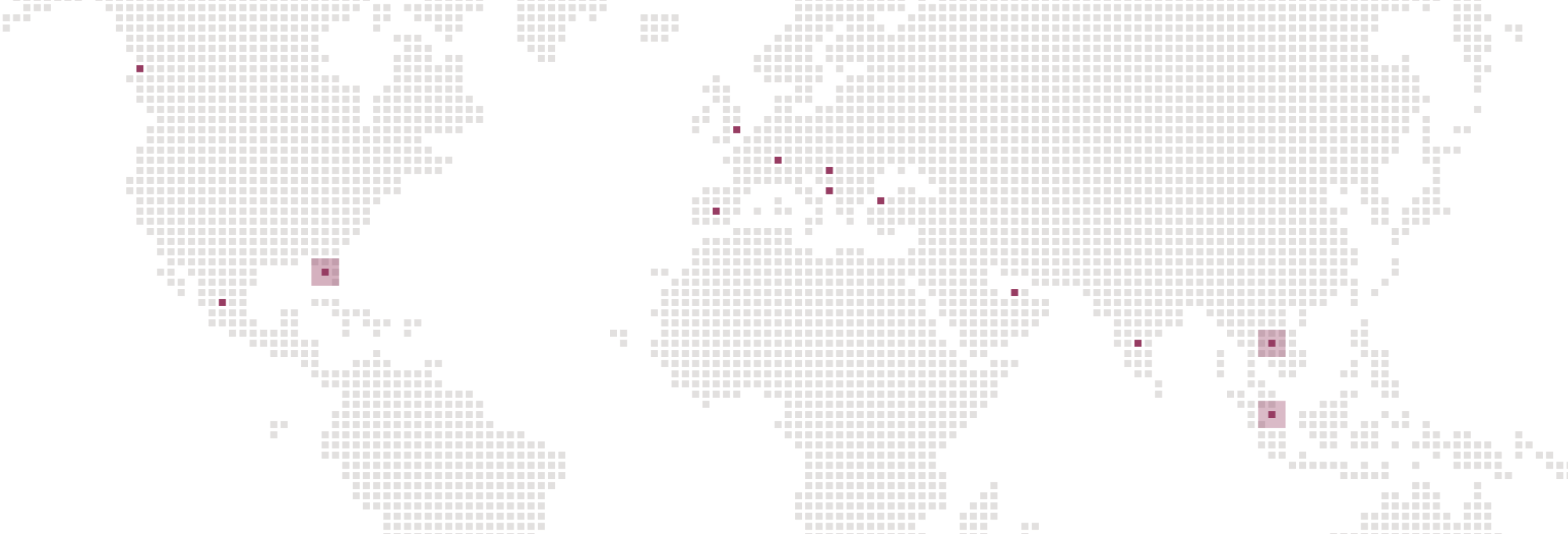

GLOBAL PRESENCE

Mbanq Head Office

4850 Tamiami Trail N Suite 301 Naples, FL 34103

+1 (888) 999-5467 | hello@mbanq.com

Mbanq Seattle HQ

19800 N Creek Pkwy Ste. 202

Bothell, WA 98011 USA

Mbanq India

Vasant Business Centre, No.15, second floor, Queens road, Vasanth Nagar, Bengaluru-560052

India

Mbanq UK

Regus, Vision Park, Chivers Way, Histon, Cambridge CB24 9AD

United Kingdom

Mbanq Montenegro

Rimski trg 4, 81000 Podgorica

Montenegro

Mbanq Croatia

Ribarska 4, 31000 Osijek

Croatia

HISTORY

Founded in 2016, Mbanq established itself as a leading provider of digital banking technology and support services for traditional banks, neobanks, FinTechs, credit unions and non-financial brands.

Headquartered in the USA, the company has technology development, regulatory and compliance and services support teams across Europe, the Middle East, Asia and the Caribbean.

Today, Mbanq operates millions of accounts on behalf of its client platforms and drives industry-leading technology and services innovation.

2016

Founded and incorporated in the USA

Acquires banking core provider (established in 2002)

Acquires European development team

Banking technology infrastructure major upgrade

2017

Expands US regulatory and compliance teams and services

Launches Accelerator Program in Singapore

Sales and delivery pipeline ramps up

First Bank license sponsor relationships established

2018-2019

Acquires Agility Four to service Credit Unions

Reaches profitability

Technology upgrades

Innovates services portfolio strategy

2020

Core technology platform Mbanq Sky

Enhanced services solutions:

- Compliance- as-a-Service

- Regulatory- as-a-Service

- Dispute Resolutions-as-a-Service

Industry leader in regulatory and compliance support

2021

Establishes Mbanq CUSO

First in world Credit Union-as-a-Service (CUaaS)

Partners with Temenos to enhance technology and services

Partners with Galileo to enhance card issuing

2022

India technology development team and office in Bangalore

Lending-as-a-Service

Fourth accelerator cohort graduates from Mbanq Labs

US and worldwide banking technology patents granted

2023

Millions of accounts across client platforms

Embedded Banking for industries and brands

Major expansion of as-a-service portfolio

2024

High profile brand launch

Market leader in embedded finance in USA

Market leader in embedded finance in Caribbean

Expansion to Latin America

Nebula – world’s most modern core banking system

2025-2026

AI technology integration

Comet – Standalone AI-powered digital loan origination platform

Eclipse – Next-gen card issuing platform

White-label mobile app for iOS and Android

New partner banks in Europe and USA

ASEAN region expansion

AI technology in digital finance – roadmap through to 2035

LEADERSHIP & FOUNDERS

Vlad Lounegov

CEO (Seattle, USA)

Previously:

Co-founded PwC FinTech Practice

20+ years Big Four banking and FinTech consulting (KPMG, EY, PwC)

Lars Rottweiler

CTO (Zurich, Switzerland // Dubai, UAE)

Managing Director, Deutsche Bank

25+ years top-flight banking and consulting roles

(Deutsche Bank, PwC, Accenture, Infosys)